Simply put, you get coverage when you drive any kind of personal car you have regular access to as long as it is not registered in your employers name, any person living in the exact same home as you or your very own name - cheap car insurance.

A Texas non-owner insurance coverage from ABC Insurance Providers will certainly supply you with Texas responsibility insurance protection for any car that you are driving (Other than household autos). It is essential to bear in mind that a Texas non-owner insurance policy is made use of as second insurance coverage in case of an accident. The insurance policy of the cars and truck's owner will certainly be used first, as well as your non-owner plan will start to cover any kind of problems past that primary protection (cheaper auto insurance).

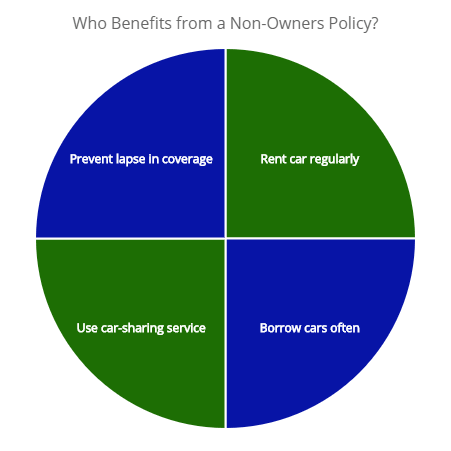

If you do not have a cars and truck however regularly drive one, whether you borrow an auto from a good friend or make use of a car-sharing service, you should take into consideration non-owner responsibility insurance coverage. Non-owner responsibility insurance coverage covers you for damages that you might trigger to another person's vehicle as well as liability for injuries to its residents or to pedestrians in the occasion of a mishap. cheap car insurance.

If you do not possess a car, consider this kind of insurance coverage if: You regularly lease autos. cheaper auto insurance. Rental companies offer protection each time you rent out an auto, but at a cost of $7 to $14 a day, according to the Insurance policy Details Institute, spending for this protection can obtain expensive.

If you're at mistake for the mishap as well as the various other vehicle driver's injuries surpass the auto owner's liability protection, you would certainly be accountable for the rest of the expense. If you had non-owner obligation, it would cover the extra (cheap auto insurance). If the car belongs to your roommate or an additional person you share a home with, damages you create might not be covered by that person's insurance coverage.

An Unbiased View of Non-owner Car Insurance: Do You Need It And How Much Is It?

In one means or an additional, many tiny companies require to use a car or truck to carry out organization. insurers. Oftentimes a sales representative may require to drop off a contract to a purchaser at her office. If the agent makes use of a company-owned cars and truck that is insured by the firm and enters an accident along the road, business is covered.

If an employee uses his/her automobile on any errand related to the service as well as is involved in an automobile collision, the proprietor of the business can be held answerable for associated losses. The keywords are "any type of errand - trucks." If a staff member is asked to get a client from the flight terminal, go down off a firm letter at the post office or get ink for the printer at the workplace supply business, these are all firm duties, also if they are completed in the staff member's very own cars and truck.

Bear in mind, while wide protection terms as well as conditions are common in non-owned and worked with auto liability insurance, not all policies are alike. trucks. Numerous policies exclude bodily injuries to the employee and to non-employees such as a partner, child or parent that might be in the cars and truck at the time of the mishap.

The chauffeur's car insurance plan would select up those costs. Various other plans require entrepreneur to have liability insurance policy on their industrial auto plans to lug non-owned and also employed responsibility insurance, with the exact same financial limitations of security for both (cheap car insurance). The very best method to identify what coverage restrictions are needed is to go over the operations of the service with a expert insurance coverage agent.

Keep reading to find every little thing you need to understand about Allstate's non-owner vehicle insurance as well as exactly how it functions. What Is Allstate's Non-Owner Vehicle Insurance? Allstate's non-owner auto insurance is a vehicle insurance plan for drivers that do not own automobiles. Allstate, like several insurance providers, enables vehicle drivers to buy insurance policy even if they do not have a car.

The 9-Second Trick For Cheapest Non Owner Car Insurance

vehicle credit low-cost auto insurance insure

vehicle credit low-cost auto insurance insure

Your Allstate non-owner car insurance plan works comparable to a basic car insurance coverage Without the underlying lorry. You purchase liability coverage to satisfy or go beyond the minimum restrictions in your state, and you get added defense when driving (auto insurance). That Should Purchase Non-Owner Auto Insurance Coverage from Allstate? Allstate's non-owner car insurance is ideal for chauffeurs that desire added insurance coverage also if they do not own a vehicle.

With complete protection, you're shielding a car - accident. With non-owner automobile insurance coverage, you're not. Factors that Influence the Cost of Allstate Non-Owner Cars And Truck Insurance When you buy non-owner cars and truck insurance policy, the worth of the automobile does not matter. You're not guaranteeing a car. You're guaranteeing on your own. The cost of non-owner vehicle insurance policy from Allstate differs based upon the following variables: Driving Background: Do you have a background of safe driving? Or do you have numerous at-fault mishaps and also various other events within the last few years? Your motoring history is one of the largest variables affecting the expense of non-owner vehicle insurance coverage.

Your non-owner insurance coverage may be the key insurance when renting out an automobile or utilizing a car-sharing service. Does Allstate Have Good Non-Owner Auto Insurance Policy? Exactly how to Get a Quote for Allstate's Non-Owner Auto Insurance coverage Allstate does not give non-owner vehicle insurance prices quote online.

vehicle insurance insure cheaper car insurers

vehicle insurance insure cheaper car insurers

Asking for a quote from Allstate does not obligate you to get a plan. You can request a non-owner automobile insurance quote from Allstate, State Farm, and other significant insurance companies before selecting the very best policy for you (car). Last Word on Allstate's Non-Owner Car Insurance coverage Allstate is Find out more one of several significant insurers providing non-owner automobile insurance.

10 Simple Techniques For Non-owner Car Insurance

To learn even more regarding Allstate's non-owner car insurance plan or to request a quote today, contact Allstate.

cheaper cars vehicle insurance car insurance insure

cheaper cars vehicle insurance car insurance insure

Basically every state in the united state needs vehicle owners to have vehicle insurance. It's also possibleand sometimes smartto get a plan also if you do not own an auto. Right here's exactly how to know whether you must think about non-owner auto insurance and where to get it if you make a decision in the affirmative.

Non-owner vehicle insurance policy generally does not offer medical coverage for you if you remain in an accidentalthough this can vary by state and also according to the policy you acquire. This sort of vehicle insurance is thought about additional insurance coverage. That means it pays cases only after the vehicle proprietor's policy has actually compensated to the limits of its protection.

Non-owner car insurance policy makes the many sense if you are an uninsured driver and one or even more of the following holds true: You obtain cars with only very little liability protection If you borrow an automobile from somebody whose automobile insurance plan just satisfies their state's minimum obligation demands and also you have a mishap, you may be responsible for any bodily injury or building damage cases that go beyond the coverage on that particular plan (auto insurance).

vehicle cheaper low cost laws

vehicle cheaper low cost laws

That coverage is usually restricted to damage to the cars and truck itself and also does not include the kinds of responsibility protection that a routine or non-owner insurance policy offers. low-cost auto insurance. According to the Insurance Info Institute, rental cars and truck companies are needed by law to provide the minimum quantity of obligation insurance protection mandated in that state, but as we have actually pointed out, that might not suffice in a major crash.

All about Do You Need Non-owner Car Insurance? - Progressive

If you're taking into consideration getting rid of your automobile as well as dropping your normal insurance coverage, ask if your insurance company uses a non-owner auto plan. That might assist you avoid a costly space in insurance coverage ought to you choose to own a vehicle once more. As with most types of insurance coverage, it's a good idea to check with your state insurance policy department to see if the insurance firm is licensed to do organization in your state as well as whether the division has any type of problems on data.

Lots of state insurance coverage divisions post that info on their internet sites. The National Organization of Insurance Policy Commissioners (NAIC) additionally has a Consumer Information Look tool, where you can seek out insurance providers and also look at any kind of issues against them. An independent insurance policy representative in your neighborhood could also be a great resource.

low cost auto dui suvs car

low cost auto dui suvs car

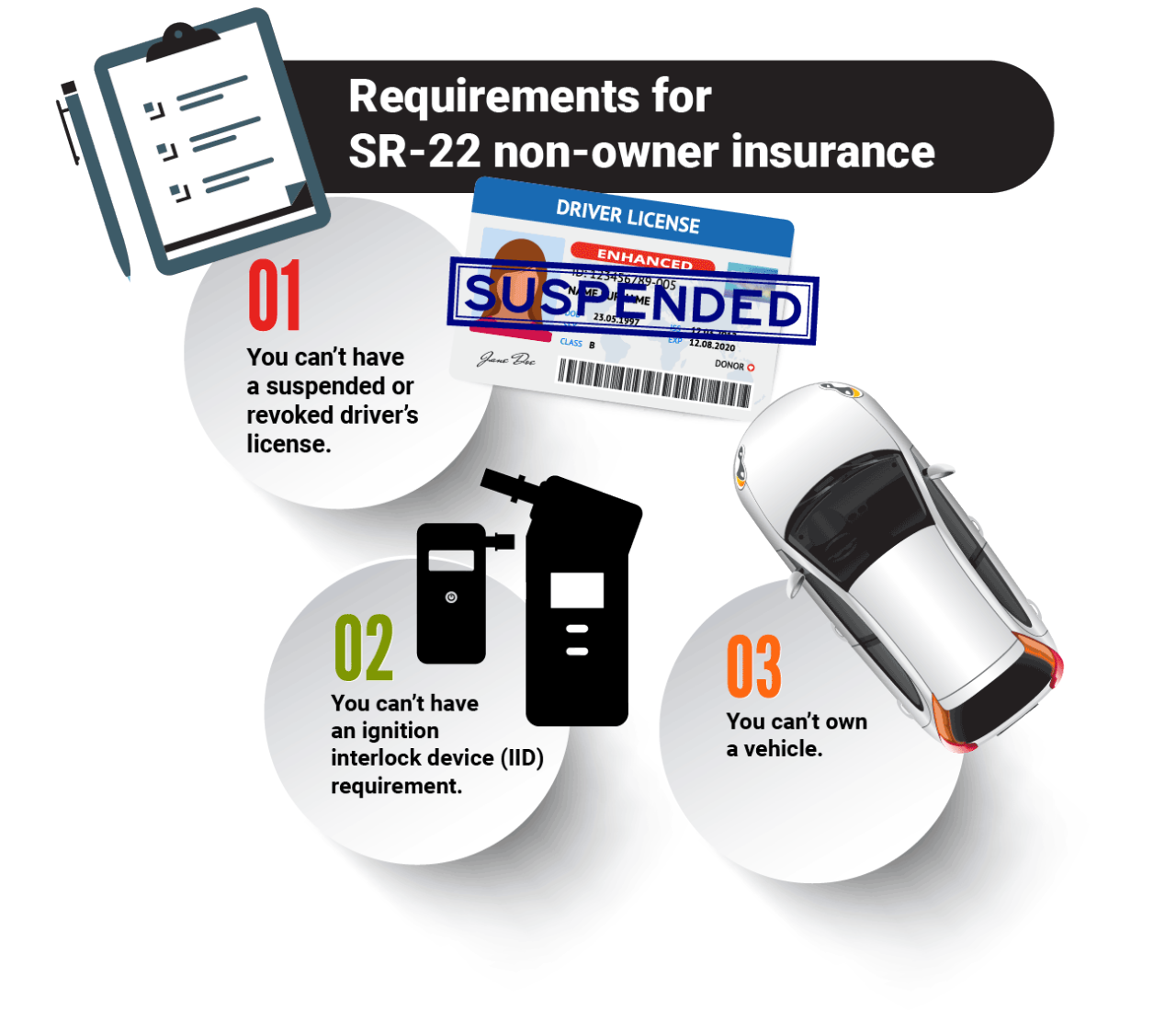

There's been a concern with your chauffeur's certificate or you've been briefly without an auto, however now you're prepared to get back on the roadway. What Is Non-Owner Car Insurance? Non-owner car insurance is an obligation policy.